Role of Tax Consultants in Business Planning and Strategy

A tax consultant is a professional who specializes in tax law, compliance, and planning. They possess extensive knowledge of all tax regulations and are skilled in interpreting and applying these laws to help individuals or businesses minimize their tax liabilities while ensuring compliance with all tax-related requirements.

Roles and Responsibilities of a Tax Consultant

Closely examining the tasks and obligations of a tax consultant sheds light on their role in simplifying tax matters. Let’s explore what tax consultants do and how they benefit individuals and businesses.

- Tax Planning: Tax consultants specialize in devising strategies to minimize tax liabilities for individuals and businesses. They provide strategic advice on how to structure financial transactions and operations in the most tax-efficient manner. Additionally, tax consultants offer insights into future tax projections, helping clients make informed decisions based on their tax implications.

- Tax Compliance: A fundamental role of tax consultants is to ensure compliance with tax laws and regulations. They are responsible for accurately preparing and filing tax returns on behalf of their clients. This involves thorough documentation and record-keeping to maintain a clear and organized financial history, ensuring that clients meet their legal tax obligations.

- Keeping Abreast of Tax Laws: Tax laws and regulations are subject to change, making it crucial for tax consultants to stay updated. They invest time in continuous education to remain informed about the latest developments in tax laws and accounting standards. In turn, they share this knowledge with their clients, providing valuable insights into how these changes may impact their financial situation.

- Audit and Representation: When faced with tax audits or inquiries from tax authorities, clients rely on tax consultants for support and representation. Tax consultants assist clients during these processes, offering guidance, preparing necessary documentation, and negotiating settlements when required, safeguarding their clients’ interests.

- Risk Management: Identifying potential tax-related risks is another key responsibility. Tax consultants assess the tax vulnerabilities of their clients and provide guidance on strategies to mitigate these risks. This proactive approach helps businesses navigate complex tax landscapes with confidence.

- Strategic Business Decision Support: Tax consultants play an integral role in strategic planning. They analyze the tax implications of major business decisions, such as mergers, acquisitions, or expansions. By providing tax-efficient options and insights, they assist clients in making strategic decisions that align with their financial goals.

- International Taxation: For businesses operating globally, tax consultants possess expertise in navigating international tax laws. They ensure compliance with the tax requirements of various international jurisdictions while minimizing tax liabilities on a global scale.

- Employee Compensation and Benefits: Tax consultants advise on structuring employee compensation and benefits packages in a tax-efficient manner. They ensure compliance with employment tax laws, helping businesses attract and retain talent while managing their tax obligations.

Importance of Tax Saving in Business

Tax planning is crucial for businesses, helping them save money, make smart decisions, and ensure they follow the law. Let’s look at some of the many benefits.

- Cost Savings: Effective tax planning can significantly reduce a business’s tax liability. By identifying and utilizing available tax deductions, credits, and incentives, businesses can lower their overall tax expenses. This translates into more money retained for operational and growth purposes.

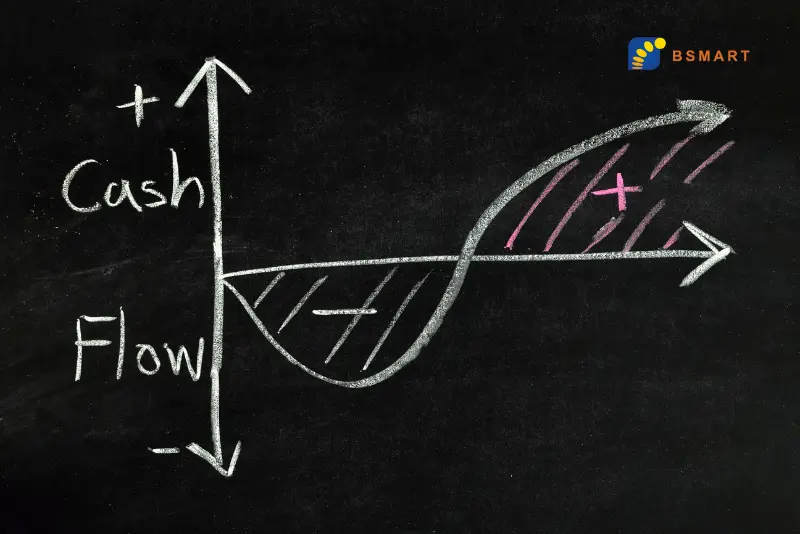

- Improved Cash Flow: Tax planning ensures that a business allocates its resources efficiently. By managing tax payments strategically, a company can avoid unexpected financial burdens and maintain healthy cash flow throughout the year.

- Legal Compliance: Staying compliant with tax laws and regulations is not just an ethical duty but a legal requirement. Tax planning helps businesses understand their obligations, file accurate returns, and meet deadlines, minimizing the risk of penalties, interest, or legal issues.

- Strategic Decision-Making: Tax considerations often play a pivotal role in major business decisions. By factoring in tax implications when making choices regarding investments, expansions, mergers, or acquisitions, businesses can optimize their strategies for long-term financial success.

- Resource Allocation: Tax planning helps businesses allocate resources more efficiently. By minimizing taxes, companies can invest more in research and development, employee development, marketing, and other essential areas that drive growth and competitiveness.

- Competitive Advantage: When businesses effectively manage their tax liabilities, they can lower their costs and potentially offer more competitive pricing to customers. This can lead to increased market share and enhanced competitiveness within their industry.

- Risk Management: Tax planning includes identifying and managing potential tax-related risks. This proactive approach minimizes the chance of facing unexpected tax disputes or financial setbacks, providing a sense of security for business owners.

- Long-Term Sustainability: A well-thought-out tax strategy is a crucial component of long-term sustainability. By minimizing tax liabilities and maximizing cash flow, businesses can endure economic downturns, adapt to changing market conditions, and invest in their future growth and success.

Role in Business Structure and Planning

One of the fundamental responsibilities of tax consultants is to provide expert guidance on shaping the structure of a business to achieve optimal tax efficiency. This involves two critical aspects:

-

- Advising on Tax-Efficient Business Structures:

Choosing the right business structure is essential for minimizing tax liabilities while ensuring the business operates smoothly. Tax consultants assist in evaluating and selecting the most suitable structure, taking into account the unique needs and goals of the business. Common business structures include sole proprietorships, partnerships, corporations, and limited liability companies (LLCs).

-

- Sole Proprietorship: Suitable for single owners, offering simplicity but potentially exposing personal assets to business liabilities. Tax consultants help sole proprietors understand their tax obligations and deductions.

- Partnerships: Tax consultants provide insights into partnership structures, including general partnerships and limited partnerships. They help distribute profits and losses among partners efficiently.

- Corporations: Tax consultants advise on the tax implications of incorporating a business. They explore options such as S corporations and C corporations, considering factors like taxation of profits, dividends, and ownership structure.

- Limited Liability Companies (LLCs): Tax consultants explain the flexibility and tax benefits of forming an LLC, helping businesses limit personal liability while enjoying favorable tax treatment

- Planning Business Expansions or Contracts with Tax Implications in Mind:

Business growth and change often have significant tax implications. Tax consultants play a crucial role in helping businesses plan for expansions or contractions while optimizing their tax positions. Key considerations include:

- Expansion Strategies: Tax consultants assess the tax implications of expanding the business, whether through new locations, acquisitions, or diversifications. They identify opportunities to maximize deductions and credits associated with expansion costs.

- Contracting Strategies: When a business needs to downsize or restructure, tax consultants provide guidance on minimizing tax liabilities associated with asset sales, employee layoffs, or the closure of business divisions. They help navigate potential tax consequences, ensuring a smooth transition.

Future of Tax Consultancy in Business Planning

As businesses evolve and tax laws become increasingly complex, the role of tax consultants is set for significant transformation. Let’s look at some of the emerging trends and the evolving nature of tax consultancy, along with the integration of new tools and technologies.

- Digital Transformation: The digitization of financial processes is changing how businesses manage their tax affairs. Tax consultants are adapting by providing guidance on digital tools for record-keeping, data analysis, and tax compliance.

- Sustainability and ESG Reporting: Environmental, Social, and Governance (ESG) reporting is gaining prominence in business planning. Tax consultants are increasingly involved in helping businesses navigate the tax implications of sustainability initiatives and reporting, aligning tax strategies with ESG goals.

- Global Tax Transparency: International tax transparency initiatives, such as the Common Reporting Standard (CRS) and the Automatic Exchange of Information (AEOI), are creating a more transparent tax environment. Tax consultants are assisting businesses in complying with these global reporting requirements.

- Remote Work Tax Implications: The rise of remote work has tax implications related to employee taxation, payroll tax, and state tax matters. Tax consultants are advising businesses on how to manage these new complexities in a post-pandemic work environment.

Exploring New Tools and Technologies in Tax Consultancy:

- AI and Automation: Artificial intelligence (AI) and automation are revolutionizing tax consultancy. Advanced software can analyze vast amounts of data to identify tax-saving opportunities, detect anomalies, and streamline compliance processes.

- Blockchain Technology: Blockchain is enhancing transparency in financial transactions and supply chains. Tax consultants are exploring how blockchain can improve the accuracy and traceability of tax-related data.

- Data Analytics: Data analytics tools are becoming essential for tax consultants to uncover insights from financial data. Predictive analytics can help businesses forecast tax liabilities and make informed decisions.

- Cloud-Based Solutions: Cloud-based accounting and tax software provide real-time access to financial data, enabling tax consultants to collaborate with clients more efficiently and offer timely advice.

Tax Consultancy Services for Business

Tax consultancy services provide crucial help with regular tax filings and offer smart advice to help businesses save money and stay financially healthy. They understand tax laws really well and adjust their guidance to fit each business’s specific needs and aims. These professionals are key in helping businesses deal with complex tax issues, making sure everything is in compliance, and reducing the risks of mistakes. As tax rules keep changing, having a dependable tax consultant can lead to big financial benefits, promoting honesty and careful money management. By choosing professional tax consultancy services, businesses can protect their money, make smarter choices, and focus on growing and innovating.