The Impact of Technology on Investment Banking Services

Entrepreneurs and startup founders are always buzzing with new ideas and ways to change the market. But while they’re busy thinking about products and services, the detailed work of financial planning can sometimes get overlooked. And that’s where financial consultancy steps in.

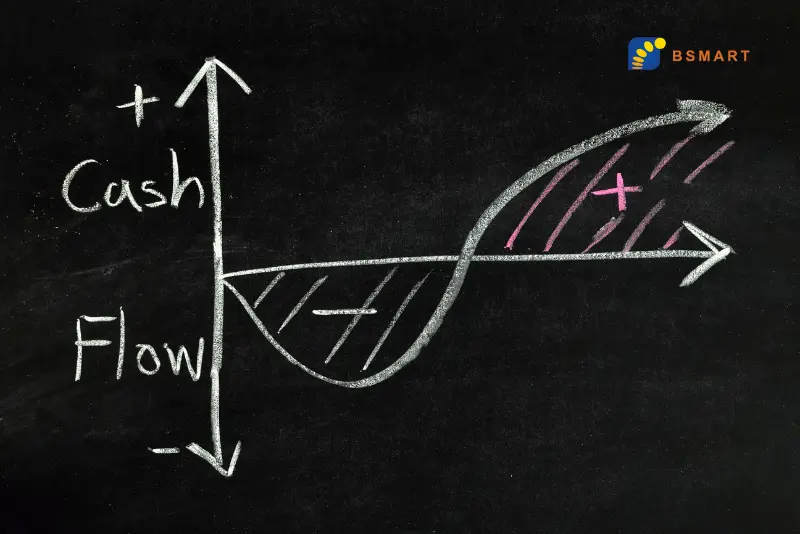

Financial consultants help these passionate innovators turn their ideas into practical business plans. They help startups understand how money comes in and goes out with cash flow management. They assist in setting clear budgets so businesses know how much they can spend and forecast what their finances might look like in the future.

It’s not just about tracking money, though. Financial consultants ensure startups follow all the rules, helping them understand and meet any legal requirements tied to finances. They also offer advice on big decisions like partnering with other companies or even merging.

So, while entrepreneurs bring the exciting ideas to the table, financial consultants help make sure those ideas are built on a solid financial foundation. This way, startups don’t just start; they thrive.

Importance of Financial Consultancy and Solutions

Financial consultancy plays a pivotal role in ensuring the financial health and sustainability of businesses. Whether you’re an entrepreneur just starting out or a well-established business, understanding the importance of financial consultancy can be the difference between success and failure. Here’s why it matters:

- Expertise: Financial consultants have specialized training in finance. They stay updated on market shifts, new financial regulations, and best practices in managing money. Their expertise ensures your business gets the best financial advice, even if you’re not a finance expert.

- Future Planning: Predicting financial trends is challenging. Financial consultants analyze your business’s current status and the market to give insights on what to expect in the future. This helps you prepare for ups and downs, ensuring you’re never caught off guard.

- Risk Management: Every business faces financial risks. It could be fluctuating market conditions or unexpected expenses. Financial consultants identify these risks early and help you develop strategies to handle them, keeping your business stable.

- Optimized Decision Making: Making decisions based on accurate financial data is crucial. With the insights provided by consultants, you can confidently decide when to invest, when to expand, and where to allocate resources.

- Cash Flow Management: Running out of cash can halt operations. Financial consultants help ensure you always have enough money on hand. They’ll offer strategies to manage your income and expenses so you can pay bills, salaries, and invest in opportunities when they arise.

- Regulatory Compliance: Finance laws and regulations change. Falling out of compliance can lead to penalties. Consultants keep track of these changes for you, ensuring your business always adheres to the latest financial regulations.

- Asset Management: Managing assets, like investments or properties, requires expertise. Financial consultants ensure these assets are performing well. If an investment isn’t providing the returns you expect, they’ll suggest changes.

- Cost Savings: Every business aims to save money. Financial consultants review your expenses to identify where you might be overspending. They provide actionable insights to cut unnecessary costs without affecting your business operations.

- Growth Strategy: Growing a business isn’t just about increasing sales. It requires a solid financial plan. Consultants guide you on how to grow in a way that’s financially sustainable, ensuring your business expands without overextending.

Impact of Financial Solutions on Different Verticals of Business

Financial solutions have a broad-reaching impact on almost every aspect of a business. From streamlining operations and securing sustainable growth to enhancing decision-making and ensuring compliance, they lay the foundation for a company’s success. These solutions, tailored to the unique needs of each enterprise, are the behind-the-scenes champions, fostering stability, predicting challenges, and paving the way for opportunities. Here’s a look at how financial solutions influence different verticals of a business:

- Operations:

Financial solutions ensure that operations continue running smoothly by ensuring that bills, salaries, and vendors are paid on time. Proper financial management also means funds are available for emergency repairs or upgrades, preventing potential operational downtimes. - Growth & Expansion:

For a business to grow or expand into new markets, significant investments may be needed. Financial planning and forecasting play a crucial role in determining when and where to expand. Having access to the right financial tools and solutions can streamline this process, from assessing the feasibility of expansion to securing the necessary capital. - Sales & Marketing:

Effective financial solutions provide clarity on how much can be invested in marketing campaigns or new sales initiatives. They also allow for tracking the return on investment (ROI) from these ventures, ensuring that resources are being utilized effectively. - Human Resources:

Financial tools help HR in payroll management, benefits administration, and in budgeting for training or talent acquisition. Moreover, financial stability in a company can boost employee morale and retention rates. - Supply Chain & Inventory:

Financial solutions aid in managing inventory, ensuring that there’s neither an excess, leading to wastage, nor a shortage, leading to potential lost sales. It also helps in negotiating payment terms with suppliers, ensuring a smooth supply chain. - R&D and Innovation:

Businesses investing in research and development need sound financial planning to support their projects. Determining the potential profitability of a new product or feature can guide how much is invested in its development. - Compliance and Reporting:

Financial solutions ensure that businesses stay compliant with industry regulations and standards. Automated tools can aid in accurate and timely financial reporting, which is crucial for both legal compliance and stakeholder trust. - Decision-making:

At its core, every decision in business has a financial implication. Having robust financial tools and solutions means that these decisions are made with a clear understanding of their potential financial outcomes.

How to Choose the Right Financial Solutions for Your Business?

Choosing the right financial solutions is as important as choosing the right employees for your business. Better the employees, better the output and better the results. Likewise, better the financial solutions, easier it is for you to scale and grow. When considering financial options, keep these points in mind:

- Identify Your Business Needs:

Every business is at a different stage and has distinct financial requirements. Startups might find immediate value in robust cash flow management, while mature businesses may be looking ahead towards succession planning. Understand where you are on this spectrum to make informed decisions. - Evaluate the Expertise of the Service Provider:

It’s not just about hiring a financial consultant; it’s about partnering with someone who brings relevant expertise. Look for consultants with a demonstrable history, especially in pivotal areas like financial advisory and strategic blueprinting. - Scalability:

Your chosen financial solution should scale with your business. Tools and services that work for you now should also be able to accommodate your growth in the future, particularly in areas like budgeting, forecasting, and MIS reporting. - Integration with Current Systems:

Operational efficiency is key. When adopting tools, whether for cash flow visualization or financial statement analysis, ensure they merge well with your existing infrastructure. Integration minimizes disruptions and fosters smoother operations. - Transparent Pricing:

Finances are about clarity. When exploring solutions, especially critical services like insurance advisory, ensure their pricing model is transparent. Avoid any service where the costs are obscured or unclear. - Tailored Solutions:

Your business is distinct, and your financial strategies should reflect that individuality. Financial tools and services should be flexible, catering specifically to the idiosyncrasies of your operations, ensuring a snug fit for your financial plans. - User-Friendly Interface:

If you’re using digital tools for tasks like budgeting or MIS reporting, a user-friendly interface is essential. This ensures that team members at all levels can understand and effectively use the tools. - Up-to-date with Regulations:

Financial regulations evolve. Solutions, particularly those concerning the review of existing financials and assistance in finalizing business structures, should be abreast with current regulations. - Seek Recommendations:

Other business owners, especially those in your industry, can be a valuable resource. Their experiences with various financial tools and consultants can guide your decision-making. - Think Long-term:

The present is vital, but forecasting is most important aspect in financial strategies. While some areas like succession planning might seem remote now, preparing early can lead to better transitions and long-term stability in the future.

Transforming businesses one at a time, BSMART stands out as a modern financial service provider that delivers customized services to meet specific needs. With their holistic approach, BSMART assists businesses in everything from cash flow management and budget forecasting to specialized advisory on asset allocation and insurance. Beyond just offering insights on existing finances, they analyze and restructure financial documents to help businesses optimize their financial performance. BSMART’s expertise also extends to streamlining operations, assisting in determining the right business structure, and planning for leadership transitions, making them a go-to partner for businesses looking for a strong financial foundation.