Risk Management in Project Finance: A Comprehensive Overview

Project Finance refers to the funding of long-term infrastructure, industrial projects, and public services based on a non-recourse or limited recourse financial structure. In this setup, the project’s viability and potential to generate cash flow act as security for the loan. A key aspect of project finance is that financial institutions or investors rely primarily on the revenue generated by the project as both the source of repayment and the collateral for the funding.

This approach is particularly prevalent in sectors like transportation, energy, telecommunications, and public utilities. Unlike traditional methods of financing, where lenders have a claim against the overall assets of the borrowing entity, in project finance, the focus is squarely on the project’s assets and earnings potential. This unique feature allows companies to undertake large-scale and capital-intensive projects without tying up their corporate balance sheet.

Distinguishing project finance from traditional corporate finance is crucial for understanding its applications and risks. In traditional corporate finance, financial institutions consider the entire financial health of a company, including its creditworthiness and all available assets, to secure a loan. This means the risk is spread across the entire corporation’s operations. However, in project finance, the risk assessment and credit appraisal are confined to the specific project.

Therefore, lenders are more deeply involved in assessing the feasibility, cash-flow projections, and risk mitigation plans of the project itself. This approach allows businesses to pursue ambitious projects that might be too risky under traditional financing models. Furthermore, project finance often involves a complex mix of stakeholders, including sponsors, contractors, and governments, adding layers of complexity compared to conventional corporate finance methods.

The Importance of Risk Management in Project Finance:

Risk management is a fundamental component in project finance due to the unique challenges and high stakes involved in large-scale projects. These projects often require substantial investment and are subject to a wide array of risks, ranging from financial and operational to environmental and regulatory. Effective risk management is crucial because it helps in identifying, evaluating, and mitigating risks that can impact the project’s feasibility, profitability, and overall success.

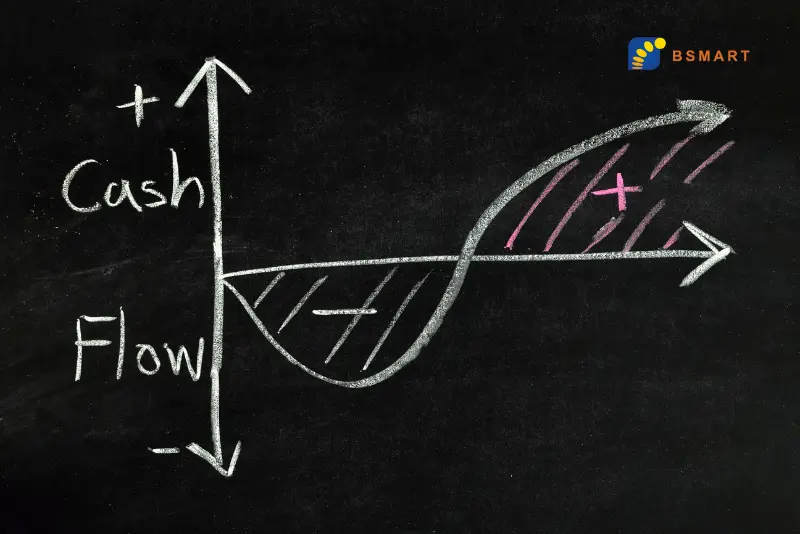

In project finance, where funding is largely dependent on the project’s cash flow, any unforeseen risk can lead to financial distress, potentially jeopardizing the repayment of loans. By proactively managing risks, project stakeholders can enhance the project’s stability, attract and retain investors, and ensure compliance with regulatory requirements. Additionally, sound risk management practices are essential for maintaining the project’s reputation and its ability to secure future funding.

The impact of risks on project finance can be profound and multifaceted. Financial risks, such as interest rate fluctuations or currency exchange volatility, can affect the cost of capital and profitability. Operational risks, including project delays or technology failures, can disrupt project timelines and increase costs. Environmental and social risks can lead to resistance from communities or regulatory hurdles, while legal risks can arise from contractual disputes or changes in legislation.

Each of these risks can significantly alter the projected cash flow and return on investment, making the project less viable. In worst-case scenarios, risks can lead to project failure, resulting in substantial financial losses for investors and lenders, and damaging the creditworthiness of the entities involved. Therefore, integrating robust risk management strategies from the project’s inception is not just a precautionary measure but a critical component for the project’s financial health and success.

Types of Risks in Project Finance:

- Market and Credit Risk: Market risk in project finance refers to the uncertainty due to changes in market conditions that can affect a project’s financial performance. This includes fluctuations in interest rates, currency exchange rates, and commodity prices. These variations can have a significant impact on project costs and revenues, especially for projects with international exposure or those reliant on specific commodities. Credit risk, on the other hand, relates to the possibility of financial loss due to a counterparty’s failure to meet its obligations. In project finance, this could involve the project company’s inability to repay loans due to lower-than-anticipated cash flows or the failure of a key customer or supplier to fulfill their contractual commitments.

- Operational Risk: Operational risk in project finance encompasses issues that affect the day-to-day functioning of the project. This includes risks related to construction delays, technical problems, management inefficiencies, and labor issues. These risks are particularly pronounced in complex projects where the technology is unproven or the project scale is large. Operational risks can lead to increased costs, project delays, or in extreme cases, project abandonment. Effective project management and contingency planning are crucial for mitigating these risks.

- Legal and Regulatory Risk: Legal and regulatory risks involve changes in laws, regulations, or government policies that can affect a project’s viability. These risks are especially relevant in industries heavily regulated by the government, such as energy, telecommunications, and transportation. Changes in tax laws, environmental regulations, or other legal frameworks can lead to additional costs or operational constraints. Furthermore, the risk of litigation, either from contractual disputes or non-compliance with laws, can have significant financial and reputational consequences.

- Environmental and Social Risk: Environmental and social risks are increasingly important in project finance, particularly for projects that have a significant impact on local communities and ecosystems. Environmental risks include issues such as pollution, resource depletion, and natural disasters, while social risks encompass community opposition, labor disputes, and impacts on local populations. Failure to properly manage these risks can lead to project delays, increased costs, and damage to the project sponsor’s reputation. It is crucial for project finance initiatives to conduct thorough environmental and social impact assessments and engage with local communities to mitigate these risks effectively.

Risk Identification and Assessment in Project Finance:

Identifying risks in project finance involves a systematic process to uncover potential problems that could affect a project’s success. This process often begins with a comprehensive review of the project plan, including its scope, resources, and timeline. Methods such as brainstorming sessions with project stakeholders, historical analysis of similar projects, and expert consultations are commonly used.

Additionally, techniques like SWOT analysis (assessing strengths, weaknesses, opportunities, and threats) and PESTLE analysis (considering political, economic, social, technological, legal, and environmental factors) are employed to gain a broader perspective of potential risks. This identification process is crucial as it lays the foundation for subsequent risk assessment and management strategies. It’s also an ongoing process, with risks being continuously identified and reassessed throughout the project lifecycle, adapting to changes in the project’s environment and scope.

Once risks have been identified, the next step is assessing and quantifying them. This assessment involves evaluating the likelihood of each risk occurring and its potential impact on the project. Techniques such as probability and impact matrices are used to categorize risks based on their severity and likelihood. For more complex projects, quantitative methods like Monte Carlo simulations or sensitivity analysis can be applied.

These techniques involve using statistical models to predict the probability of different outcomes and their potential impacts on project objectives. Financial models are also crucial in this phase, as they help quantify the potential financial impact of identified risks. This assessment is vital for prioritizing risks, guiding where to focus mitigation efforts, and informing decision-making throughout the project. Accurate risk assessment is a key factor in ensuring that the project finance structure is robust and can withstand the challenges that may arise during the project’s lifespan.

Risk Mitigation Strategies in Project Finance:

Mitigating risks in project finance involves implementing strategies to reduce the likelihood or impact of identified risks. For market and credit risks, diversification and financial hedging are common techniques. Diversification can be achieved by spreading investments across different geographic regions or sectors, reducing dependence on a single market.

Financial hedging, using instruments like futures, options, or swaps, can be employed to protect against fluctuations in interest rates, currency exchange rates, or commodity prices. To mitigate operational risks, it is essential to have robust project management practices, including contingency planning, regular performance monitoring, and employing experienced management teams. Establishing strong contracts with suppliers and contractors, with clear terms and penalties for non-performance, can also reduce operational risks.

For legal and regulatory risks, thorough due diligence is key. This includes staying informed about potential changes in laws and regulations and maintaining compliance with all relevant legal requirements. Contractual agreements can be structured to allocate these risks appropriately between the involved parties. For environmental and social risks, engaging with local communities and stakeholders from the project’s outset is crucial. Conducting thorough environmental impact assessments and implementing sustainability practices can help mitigate these risks.

Additionally, insurance plays a vital role in risk mitigation. Different types of insurance, such as liability insurance, property insurance, or political risk insurance, can provide financial protection against a range of unforeseen events. Insurance, coupled with hedging strategies, forms an integral part of a comprehensive risk management plan, providing a financial safety net and ensuring project viability against various uncertainties.

To summarise, the role of strategic risk management in project finance cannot be overstated. It demands a thorough understanding and proactive handling of various risks, including market and credit, operational, legal, and regulatory, as well as environmental and social challenges. The ability to identify, assess, and mitigate these risks not only safeguards the financial stability of a project but also enhances its potential for success.