Accounts Outsourcing for International Businesses: Managing Global Finances Efficiently

Accounts outsourcing refers to the practice where businesses delegate their accounting and financial management tasks to external specialized agencies. In simpler terms, instead of having an in-house team manage their financial records, businesses hire external companies to do this job for them.

This approach is often employed to leverage the expertise of professionals who are good at managing accounts, ensuring compliance with various financial regulations, and providing strategic financial insights. Services such as bookkeeping, payroll management, tax preparation, and financial reporting can be managed by these external agencies, freeing up businesses to focus on their core operations and strategies.

The Growing Popularity of Outsourcing in International Businesses

Have you ever wondered why some of the world’s most successful companies choose to delegate certain tasks to external service providers rather than handling everything in-house? The answer lies in the escalating trend of outsourcing in international businesses. In recent years, more and more companies have embraced outsourcing as a strategic move to enhance efficiency, reduce costs, and tap into global expertise.

- Cost Efficiency: One of the primary reasons companies choose to outsource is cost savings. Outsourcing allows businesses to access skilled labor and resources from countries with lower labour costs. This reduces operational expenses, making products or services more affordable for consumers.

- Focus on Core Competencies: By outsourcing non-core activities, companies can concentrate on their core strengths and competencies. This improves overall efficiency and enables businesses to innovate and grow in their respective industries.

- Access to Global Talent Pool: Outsourcing offers access to a global talent pool, allowing companies to tap into a diverse range of skills and expertise that may not be available locally. This can lead to higher-quality work and improved outcomes.

- Scalability and Flexibility: Outsourcing provides flexibility for businesses to scale their operations up or down quickly in response to market changes. They can adjust the scope of outsourcing contracts to meet their specific needs.

- Focus on Strategic Initiatives: Outsourcing routine tasks such as customer support, data entry, or IT support frees up valuable time and resources for companies to focus on strategic initiatives, such as product development, marketing, and expansion.

- Reduced Risk: Outsourcing can help mitigate risks associated with certain business functions. When specialized tasks are outsourced to experts, it often leads to better risk management and compliance with industry regulations.

- Improved Technology: Outsourcing partners often have access to advanced technologies and tools that may be costly for businesses to acquire and maintain. This allows companies to benefit from cutting-edge solutions without heavy investments.

- 24/7 Operations: Outsourcing to different time zones enables companies to offer round-the-clock services, enhancing customer satisfaction and expanding their market reach.

The Significance of Managing Global Finances Efficiently

Managing finances across borders may sound complex, but it’s essential for businesses that operate internationally. Let’s explore why efficient global financial management is crucial, without getting too technical.

- Sustainable Growth: Effective financial management is the key to a business’s long-term growth. It ensures the availability of funds to invest in new markets, expand product lines, and capitalize on global opportunities.

- Financial Stability: Just as a ship needs a skilled captain to navigate rough seas, efficient financial management provides stability in the face of economic turbulence. It helps a business remain resilient, even when global economic conditions are uncertain.

- Compliance and Legal Requirements: Different countries have different financial rules. Efficient financial management ensures compliance with these rules, reducing the risk of legal issues and financial penalties.

- Managing Currency Risks: Dealing with multiple currencies and exchange rates can be tricky. Efficient financial management includes strategies to minimize risks related to currency fluctuations, protecting profit margins.

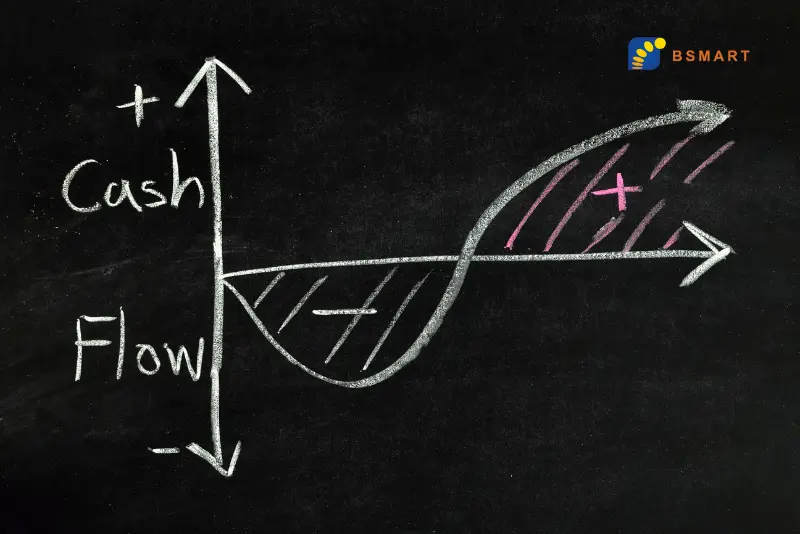

- Optimal Resource Allocation: Businesses must allocate their resources wisely. Efficient financial management involves prioritizing investments, optimizing cash flow, and managing working capital to support strategic objectives.

- Informed Decision-Making: Accurate financial information is like a compass for businesses. It helps identify profitable opportunities, assess risks, and make timely decisions that drive success.

- Cash Flow Management: Positive cash flow is essential for day-to-day operations. Efficient financial management ensures that funds are available when needed to meet obligations, invest, and grow.

- Building Trust: Investors, stakeholders, and customers trust businesses with strong financial management. It attracts investments, fosters strong relationships, and enhances the brand’s reputation.

- Risk Mitigation: Operating globally exposes a business to various risks, from political instability to supply chain disruptions. Efficient financial management includes risk assessment and strategies to mitigate these risks.

Challenges in Accounts Outsourcing

While outsourcing can propel your business and bring in more efficiency, it comes with its own set of challenges. As businesses tap into external resources for accounts management, ensuring data security, maintaining consistent quality, and overcoming communication barriers become crucial considerations. Recognizing and addressing these challenges is essential for any business seeking the true advantages of outsourcing. Let’s look at some of the main challenges related to accounts outsourcing.

- Guarding Information: Protecting sensitive financial data when outsourcing accounting tasks is vital. International businesses must ensure that their partners employ solid security measures to keep all information safe while still allowing necessary access for operations.

- Ensuring Quality and Consistency: Ensuring that financial reports are consistently high-quality and standardized, regardless of the varying expertise and methods of outsourcing partners, is critical. This involves adhering to global accounting standards and meeting the business’s unique financial management requirements.

- Clear Communication: Smooth communication can be difficult when working across borders due to time zones, cultural nuances, and language differences. Establishing strong communication channels and regular check-ins is key to ensuring alignment and clear understanding of objectives and workflows.

- Complying with Regulations: Staying compliant with various financial regulations and laws in different countries can be complex and challenging. Ensuring that the outsourcing partner is proficient in navigating different legal environments and adhering to ever-changing laws is vital.

- Balancing Control: Balancing control over outsourced financial tasks without bossing around the external partner needs careful planning and trust-building. This way, the outsourcing partner can do their job well while the business still keeps an eye on things.

- Flexible and Adaptable Operations: Ensuring the outsourcing partner can adjust to the changing needs of the business and scale operations accordingly is essential for a resilient financial management framework. This includes adapting to both expansions and contractions without sacrificing quality or punctuality.

- Technological Compatibility: Maintaining technological compatibility between the business and the outsourcing entity involves ensuring that systems, software, and processes are not only compatible but also continue to evolve with technological advancements, thereby ensuring efficient operations.

Key Metrics for Outsourcing Success

Effective measurement of success is a crucial aspect of managing outsourcing and financial operations in international businesses. By employing Key Performance Indicators (KPIs) and metrics, companies can gauge the effectiveness of their strategies and make informed decisions for continuous improvement.

- Cost Savings Ratio (CSR): This metric assesses how efficiently a company is managing its costs through outsourcing. By comparing the expenses associated with outsourcing to what it would cost to handle the same tasks in-house, businesses can gauge whether they are achieving cost savings. A declining CSR over time indicates that outsourcing is becoming more cost-effective and is likely a sign of successful cost reduction through outsourcing.

- Quality Metrics: Quality metrics evaluate the caliber of work produced by outsourcing partners. This includes measuring factors like accuracy, error rates, and adherence to industry standards. Consistently high-quality outputs from the outsourcing team indicate a successful partnership. If quality metrics show improvement over time, it demonstrates that the outsourcing arrangement is delivering reliable and consistent results.

- Service Level Agreements (SLA) Compliance: SLAs are essential documents that outline the expectations and standards for the services provided by outsourcing partners. Monitoring SLA compliance ensures that the outsourcing partner is consistently meeting the agreed-upon service levels. When SLAs are consistently met or exceeded, it demonstrates that the outsourcing partnership is delivering the quality and consistency of services that the business requires.

- Return on Investment (ROI): ROI is a crucial metric for evaluating the financial impact of outsourcing. It measures the profitability of outsourcing efforts by comparing the gains generated from outsourcing to the total investment made in outsourcing services. A positive ROI indicates that the business is reaping financial benefits from its outsourcing initiatives. A successful outsourcing strategy should aim for a positive or increasing ROI, as it signifies that outsourcing is contributing positively to the company’s financial performance.

To summarise, a successful international business operation requires a delicate balance between outsourcing select functions and maintaining strong financial management. By leveraging cost-effective outsourcing practices, monitoring quality, and complying with regulations, companies can free up resources to focus on their core competencies. Moreover, the effective measurement of success through key metrics ensures that these strategies align with business goals and contribute positively to the bottom line. In an increasingly globalized world, mastering these practices is essential for achieving long-term success and resilience in international markets.