Financial Consultancy for Entrepreneurs and Startup Founders

Financial consultancy is a specialized service that focuses on advising individuals and businesses on their financial strategies and decisions. It’s about understanding your current financial situation, setting clear goals, and planning the best route to achieve them.

Understanding Startup Finances:

Startup finances refer to the monetary aspects and financial management involved in launching and running a new business venture. This encompasses a wide range of elements, including:

- Capital Requirements: Recognise how much money is needed to launch and operate until the business becomes profitable. This includes initial costs and ongoing operational expenses.

- Sources of Funding: Understand where the money will come from. It could be personal savings, bank loans, venture capital, angel investors, or crowdfunding platforms.

- Revenue Projections: Estimate the income the startup will generate over specific periods. It’s essential to be realistic and account for variables in the market.

- Expense Management: Keeping a close eye on outgoings ensures that the business doesn’t overspend. This includes fixed costs (like rent or salaries) and variable costs (like marketing campaigns or production costs).

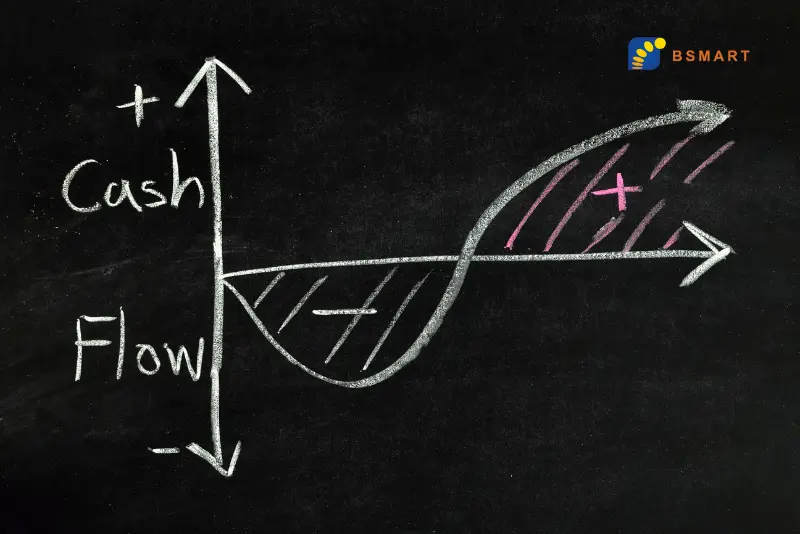

- Cash Flow: It’s not just about profit. Ensuring there’s always enough cash on hand to cover immediate expenses is crucial. Positive cash flow means the business is running smoothly, while negative cash flow can lead to insolvency.

- Break-even Point: Determine when the business will start making a profit. Knowing this point helps in setting price points, predicting profitability, and setting milestones.

- Tax Obligations: Every business has tax obligations. Being aware of what taxes need to be paid, and when, can save startups from hefty penalties.

- Financial Reporting: Regularly reviewing and updating financial statements like balance sheets, income statements, and cash flow statements provides a clear picture of the business’s financial health.

- Future Financial Planning: As the business grows, its financial needs will evolve. Planning for future investments, expansions, or diversifications is key to continued success.

Financial Consultancy for Startups

For both individuals and businesses, a financial consultant reviews all aspects of finances, from income and savings to expenditures, investments, and even potential risks. Their expertise ensures that decisions made are informed, strategic, and aligned with long-term objectives, promoting financial well-being and sustainable growth.

Here’s why financial consultancy is crucial for startups:

- Early-stage Challenges: Startups, in their early stages, face an array of challenges. With limited resources and often without a dedicated financial team, managing finances can be overwhelming. A financial consultant not only brings in experience and expertise but helps startups navigate through the initial chaos.

- Resource Allocation: Every penny counts for young companies. Financial consultants help ensure that resources are directed towards the most impactful areas, ensuring optimal use of capital and minimizing wastage.

- Risk Mitigation: Startups often encounter various financial risks. Financial consultants assist in identifying these risks and provide solutions to mitigate their impact.

- Strategic Planning: While a startup might have a revolutionary product or service, without a sound financial strategy, it might struggle to thrive. Consultants assist in plotting a course for growth, profitability, and long-term success.

- Investment and Funding: One of the significant hurdles startups face is securing funding. A financial consultant not only helps in valuating a startup accurately but also in presenting its financials appealingly to potential investors.

- Regulatory Navigation: Regulations, taxes, and compliances don’t make it easy for entrepreneurs and startup founders. Missing out on any of these can lead to hefty penalties. Financial consultant help businesses be on the right side of the law by taking care of all the regulatory aspects.

Importance of Maintaining Clear Financial Records from Day 1:

Maintaining clear financial records from the very beginning of a startup’s journey is not just a matter of good business hygiene; it’s fundamental to its survival and success. Here’s why it’s of paramount importance:

- Informed Decision Making: Accurate records not only show the current financial position of a company but the overall track record of the company. This knowledge offers predictive power. By evaluating the financial trajectory, entrepreneurs can gauge which strategies have worked in the past and which haven’t. This aids in refining future decisions regarding growth avenues, areas good for investment, and sectors where cost-efficiency can be improved.

- Preparation for Funding: Beyond just attracting investors, maintaining proper financial records prepares startups for audits —a rigorous process where potential investors dissect a company’s finances. Clean, organized financial records can make this process smoother, demonstrating a company’s dedication to transparency and accuracy, and portraying the startup as a less risky investment.

- Tax Compliance: Detailed financial records provide an itemized account of every transaction, from revenue to deductible expenses. This level of detail ensures that no tax breaks go unnoticed and all eligible deductions are claimed. More importantly, in case of tax audits, having a robust record system can save startups from unnecessary complications and potential fines.

- Cash Flow Management: Predictable cash flow is a sign of a healthy business. Regularly updated financial records allow startups to identify patterns, like peak sales months or recurring high-expense periods. By recognising these trends, startups can make anticipatory decisions, ensuring liquidity is maintained even during lean periods.

- Reducing Errors: A minor oversight today can become a major financial discrepancy in the future. Continuous and organized record-keeping means that checks and balances are in place. Regular reviews can catch anomalies early, from unintended duplicate transactions to discrepancies in billing, ensuring that the financial data remains pristine and trustworthy.

- Budgeting and Planning: Historical financial data is an invaluable asset when planning for the future. By analysing past spending and revenue patterns, startups can forecast future needs, from hiring new talent to ramping up production. This foresight ensures resources are effectively allocated, preventing over-spending and under-investing.

- Legal Protection: Business disputes, be they with vendors, clients, or employees, often revolve around financial disagreements. Meticulously kept financial records act as an unbiased third-party witness. Whether it’s confirming services rendered, proving timely payment, or validating contractual obligations, comprehensive documentation supports a startup’s stance, potentially saving it from lengthy and costly legal battles.

The Evolving Role of Financial Consultants:

The role of financial consultants has evolved over the years. It’s not just about accounting or bookkeeping anymore, but about understanding complex business dynamics and creating tailor-made solutions. These professionals now work hand-in-hand with leaders to shape strategic visions, incorporating financial acumen and industry insights. With the rise of digital transformations, they are at the forefront of integrating technology into financial operations, ensuring efficiency and real-time data analysis. Let’s explore some facets of their evolving role:

- Integration with Technology: Modern financial consultants don’t just rely on spreadsheets; they leverage advanced tech tools and platforms. Their collaboration with IT experts ensures that businesses get the most out of finance-specific software, from AI-powered analytics to cloud-based accounting systems.

- Holistic Business Strategy: The financial perspective is crucial in every business decision, from launching a new product to entering a new market. Consultants analyse financial data to help businesses make informed choices, ensuring that every strategy boosts the bottom line.

- Environmental and Social Governance (ESG): Sustainability isn’t just a buzzword; it’s a business imperative. Financial consultants help firms weigh the financial benefits of sustainable practices, making it easier for them to invest in eco-friendly operations or community upliftment initiatives.

- Globalization Advisories: Global markets offer immense opportunities and challenges. Financial consultants decode the financial implications of operating in various jurisdictions, considering factors like currency fluctuations, local taxation, and regional economic trends.

- Education and Training: Empowering a team with financial knowledge can lead to better business outcomes. Financial consultants often conduct workshops or training sessions, teaching teams to read financial statements, budget effectively, or understand the nuances of financial compliance.

- Crisis Management: Whether it’s a sudden market crash or a global pandemic, crises are unpredictable. Financial consultants provide strategies for business continuity, from identifying alternative revenue sources to re-allocating resources for maximum efficiency.

- Innovative Financing Solutions: The financial world is evolving rapidly. Gone are the days when bank loans were the only source of capital. Consultants help businesses explore newer, often more flexible financing options, whether it’s raising money through a Kickstarter campaign or navigating the intricacies of cryptocurrency investments.

In essence, financial consultants have transitioned from being mere advisors to becoming integral parts of the strategic business process, helping firms navigate both current challenges and future opportunities.

Over time, financial consulting has proved to be a valuable asset for every organization, helping them drive business and tap into unexplored areas of growth. In summary, beyond mere number tracking and record keeping, a financial consultant brings in-depth insights, strategic planning, and a foresight that’s essential for business evolution.

For entrepreneurs, wearing multiple hats is part and parcel of the startup journey. However, as businesses grow, the complexities of financial management can become overwhelming. By entrusting financial operations to skilled consultants, entrepreneurs can alleviate their burden. This not only ensures that finances are managed with precision and expertise but also frees up valuable time.

BSMART is known for its solid financial advice. They’ve helped both new and old businesses manage their money better. If you’re looking for a financial team that understands your business and gives clear guidance, BSMART is a go-to choice. They make finance less complicated, letting business owners focus on what they do best.